7 Prem Watsa BlackBerry Ltd Trades

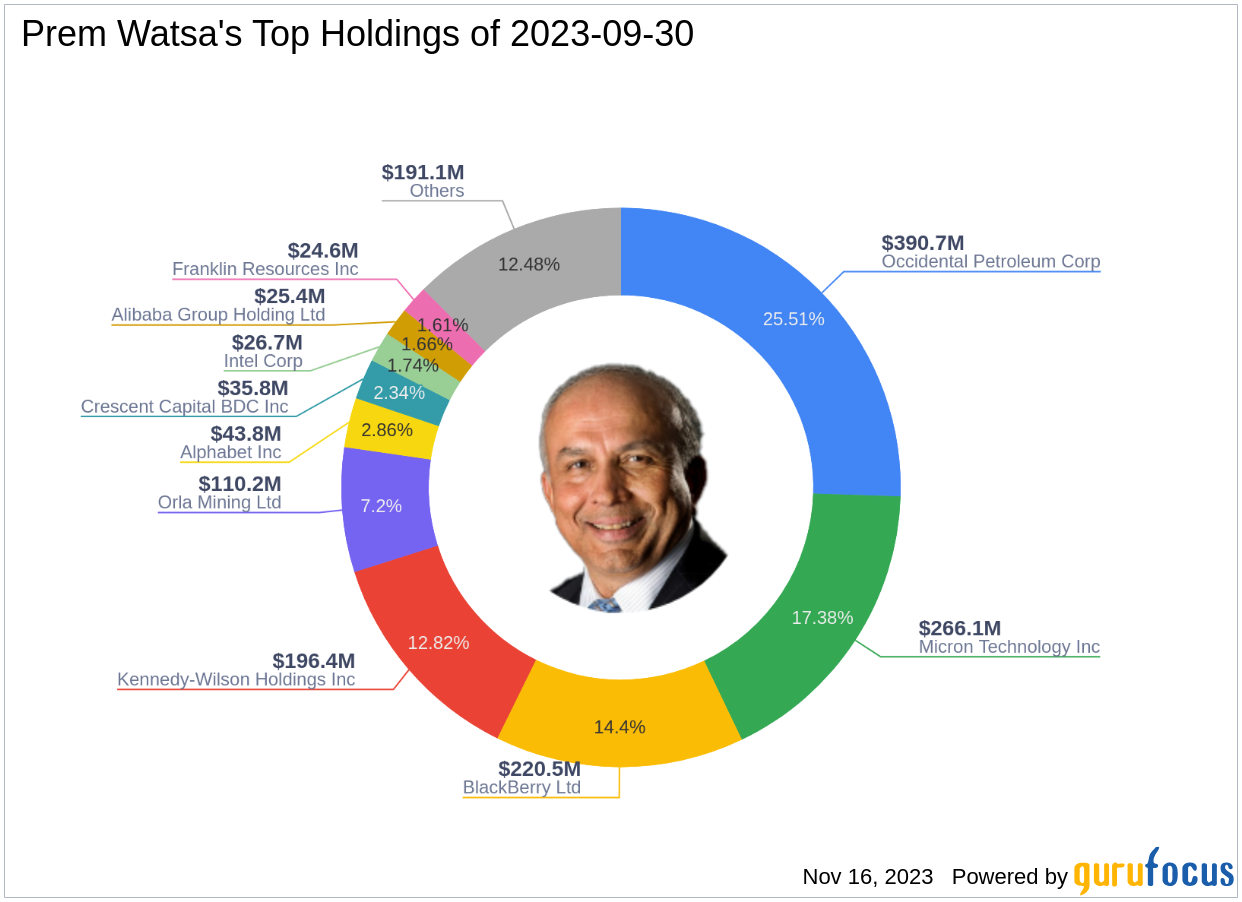

Prem Watsa acquired 40.8M BlackBerry Ltd shares worth $155M. That's 7.60% of their entire equity portfolio (5th largest holding). The investor owns 6.81% of the outstanding BlackBerry Ltd stock. The first BlackBerry Ltd trade was made in Q3 2013. Since then Prem Watsa bought shares three more times and sold shares on three occasions. The investor's estimated purchase price is $314M, resulting in a loss of 51%.

News about BlackBerry Ltd and Prem Watsa

BlackBerry names Philip Brace to board, Prem Watsa steps down

https://www.investing.com/news/stock-market-news/blackberry-names-philip-brace-to-board-prem-watsa-steps-down-93CH-3298452

Prem Watsa Bolsters Stake in BlackBerry Ltd

Prem Watsa Bolsters Stake in BlackBerry Ltd

: BlackBerry announces extension of convertible debt

Security software provider BlackBerry BB on Monday said it had fully repaid $365 million in convertible debt issued in 2020, and also announced a deal for an...

Which Is a Better Contrarian Buy: Air Canada or BlackBerry?

Warren Buffett and Prem Watsa are contrarian investors. Between Air Canada (TSX:AC) and BlackBerry (TSX:BB), which stock is a contrarian fit? The post Which ...