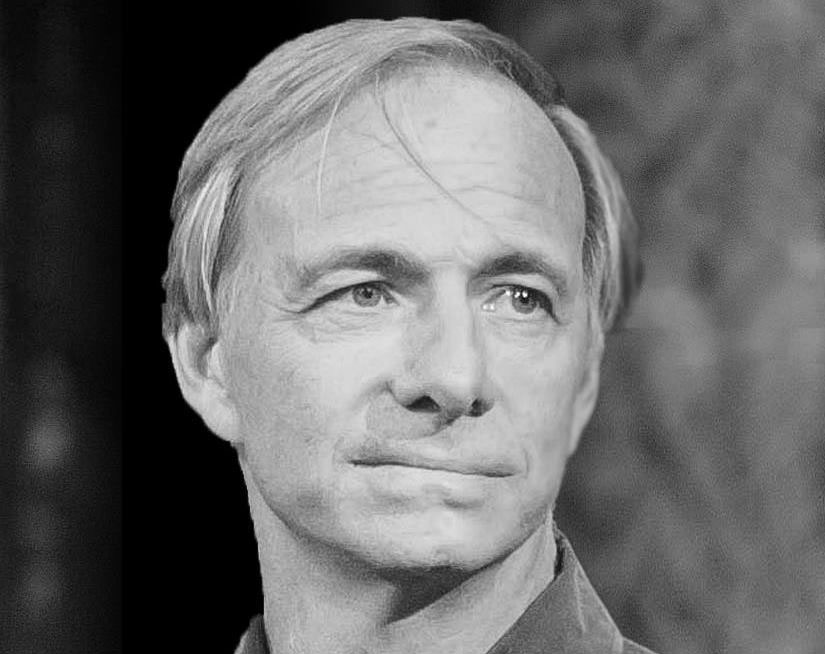

68 Ray Dalio Exxon Mobil Trades

Ray Dalio acquired 968k Exxon Mobil shares worth $109M. That's 0.42% of their equity portfolio (56th largest holding). The first Exxon Mobil trade was made in Q4 2005. Since then Ray Dalio bought shares 33 more times and sold shares on 36 occasions. The stake costed the investor $93.2M, netting the investor a gain of 17% so far.

Avg closing price

Price range

Increased shares by 354.9% (+755k shares)

Q2 2025

Avg closing price

$106.89

Price range

$99.93

-

$119.04

Sold 55.3% shares (-264k shares)

Q1 2025

Avg closing price

$110.52

Price range

$105.44

-

$118.93

Sold 47.7% shares (-435k shares)

Q4 2024

Avg closing price

$116.68

Price range

$105.68

-

$125.37

Sold 3.2% shares (-29.7k shares)

Q3 2024

Avg closing price

$115.50

Price range

$109.72

-

$119.00

Increased shares by 521.4% (+790k shares)

Q2 2024

Avg closing price

$116.47

Price range

$108.36

-

$122.20

Sold 29.3% shares (-62.7k shares)

Q1 2024

Avg closing price

$104.63

Price range

$96.80

-

$116.24

Increased shares by 5986.6% (+211k shares)

Q4 2023

Avg closing price

$105.10

Price range

$98.05

-

$115.83

Sold 97.0% shares (-115k shares)

Q3 2023

Avg closing price

$109.68

Price range

$100.92

-

$120.20

Sold 40.3% shares (-79.9k shares)

Q2 2023

Avg closing price

$109.11

Price range

$102.18

-

$118.34

Sold 65.3% shares (-372k shares)

Q1 2023

Avg closing price

$110.61

Price range

$99.84

-

$119.17

Sold 49.8% shares (-567k shares)

Q4 2022

Avg closing price

$107.14

Price range

$91.92

-

$114.18

Sold 40.4% shares (-771k shares)

Q3 2022

Avg closing price

$91.30

Price range

$83.14

-

$100.12

Increased shares by 66.4% (+762k shares)

Q2 2022

Avg closing price

$90.20

Price range

$82.26

-

$104.59

Increased shares by 17497.4% (+1.14M shares)

Q1 2022

Avg closing price

$77.73

Price range

$63.54

-

$87.78

New holding (+6.52k shares)

Q4 2021

Avg closing price

$62.50

Price range

$59.16

-

$66.36

Sold -28.3k shares

Q2 2020

Avg closing price

$44.85

Price range

$37.53

-

$54.74

Sold 18.6% shares (-6.49k shares)

Q1 2020

Avg closing price

$55.22

Price range

$31.45

-

$70.90

Increased shares by 5.0% (+1.67k shares)

Q4 2019

Avg closing price

$69.15

Price range

$66.70

-

$73.09

Increased shares by 3.0% (+964 shares)

Q3 2019

Avg closing price

$72.31

Price range

$67.19

-

$77.63

Sold 4.6% shares (-1.56k shares)

Q2 2019

Avg closing price

$77.41

Price range

$70.77

-

$83.38

News about Exxon Mobil Corp. and Ray Dalio

Billionaire Ray Dalio Loves These 10 Stocks

According to recent CEOWORLD magazine reports, Ray Dalio¡¯s hedge fund, Bridgewater Associates, has invested in several stocks. As of the end of the fourth qu...